$5 Trillion Lost: Markets Are Pricing in a Trade War

- Marcus Nikos

- Mar 17

- 4 min read

Southwest drops its most beloved perk

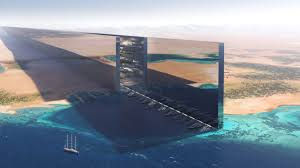

NEOM, Saudi Arabia’s futuristic mega-city, is trillions over budget and will take another 55 years to complete

Trump’s trade war will reduce U.S. GDP by 0.4%

Economic uncertainty sparks a $5 trillion market sell-off

Southwest Just Traded Its Soul for EBIT |

Southwest Airlines is walking away from one of its most iconic selling points: free checked bags. The new policy is expected to generate $800 million in earnings before interest and taxes — that’s nearly triple Southwest’s EBIT last year. Southwest shares rose 8% on the announcement. |

|

For decades, Southwest built its brand on simplicity and flexibility, setting itself apart in an industry known for nickel-and-diming passengers. The company even trademarked the phrase "Bags Fly Free," and as recently as last year, its CEO called the policy a top-three reason why customers chose Southwest. |

NEOM: Unlimited Budget Unlimited PowerPoint

NEOM was pitched as a 105-mile-long, futuristic metropolis with no cars, robot cage fights, and an artificial moon. But years into the project, reality is setting in:

The original budget was $500 billion; it’s now projected to cost $9 trillion, and construction is expected to take another 55 years.

The initial goal of building 10 miles by 2030 required constructing as much office space as three midtown Manhattans in a decade — an impossible task given labor shortages, minimal transportation infrastructure, and insufficient electricity.

An endless timeline, unlimited budget, and a prestige-driven client are the holy trinity for consultants. McKinsey is reportedly earning $130 million per year advising on NEOM.

The consulting market in the Gulf grew 13% in 2023 — far outpacing the 5% growth in the U.S. and U.K., respectively.

Whiplash Economics: Tariff Chaos Continues

Trump’s trade wars continue: Last week, the White House imposed a 25% tariff on all imported steel and aluminum, prompting retaliation from Canada and Europe. Trump briefly threatened to double the rate to 50%, only to reverse course — another episode in what has become familiar whiplash. His tariff policy has already officially shifted at least five times this year through a mix of carve-outs, delays, and reversals.

Before accounting for any retaliation, the imposed tariffs on Canada, Mexico, China, and the expansion of the steel and aluminum levies is expected to reduce U.S. GDP by 0.4% and hours worked by 309,000 full-time equivalent jobs.

History offers little comfort. Trump’s 2018–2019 tariffs inflated costs by $51 billion annually, which was mostly absorbed by U.S. companies and consumers. Reversing them would boost U.S. output by 4% over three years.

While tariffs may offer short-term relief to certain industries, they often trigger ripple effects across supply chains — helping one industry at the expense of others that rely on it.

For example: President George W. Bush’s 2002 steel tariffs helped U.S. steel producers, but industries that used steel, which employed 10 times more workers, lost more jobs than existed in the steel industry

Wall Street’s $5 Trillion Correction: The Cost of Uncertainty

U.S. stocks are having their worst start to a presidency since 2009, when Barack Obama took office amid the worst economic crisis since the Great Depression.

Since mid-February, the S&P has lost more than $5 trillion (almost six times the value of the entire U.S. trade deficit that Trump’s tariffs are attempting to narrow.)

The Nasdaq is down more than 14% from its December high.

This isn’t a crash (yet), just gravity reasserting itself. The S&P had gone 343 trading days without a correction — nearly double the historical average of 173.

Valuations were stretched: Last month, the price-to-earnings multiple of the S&P 500 was 25x, well above its long-term average of 16x.

The pain isn’t universal. The U.S. Aggregate Bond ETF is in the green, and Germany and France’s main indexes are up 17% and 12%, respectively. European equities haven't outperformed U.S. stocks by this much since 2000.

In 2018, Trump tweeted: “Trade wars are good, and easy to win.” Most economists disagree, but perhaps the more important question is: What are we fighting for?

The stock market is loud, visible, and easy to quantify — making it a convenient proxy for the economy. But in reality, it’s just one indicator. There are only around 3,400 publicly traded firms — the $28 trillion U.S. economy consists of 33 million firms.

Consumers are doing fine. JPMorgan’s data shows that spending is tracking above last year, household savings are still above 2019 levels, and the February CPI came in cooler than expected.

And even if you’re focused on the markets, zooming out puts this pullback in perspective. The Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) have shed nearly $3 trillion since their December highs. That’s a steep drop, but less dramatic when you consider they’ve added more market value in the past two years than they did over the entire eight-year stretch from March 2015 to 2023.

Let’s break down the winners and losers in this sell-off.

The winners? Traders riding the volatility, domestic steel and aluminum names, and mature dividend-paying stocks. Even then, gains are modest — more “not losing” than winning.

The losers? Big Tech is getting hit: Amazon is down 12% YTD, Apple 15%, Google 12%, Nvidia 10%. Banks — Citigroup, Morgan Stanley, Goldman Sachs — are struggling post election. Small caps are getting hammered, and Tesla is down 38% this year.

What do they all have in common? They were the “Trump trades.”

A correction is a decline in the price of an index or a stock of at least 10% but less than 20% from a recent high. It typically lasts a few weeks to a few months.

A bear market occurs when prices drop 20% or more from their highs over at least a two-month period. Corrections are common and often part of healthy market cycles, while bear markets are more severe and typically linked to economic downturns. Since the Great Recession, there have been 11 corrections in the S&P 500, but only three have turned into bear markets.